What To Do When Background Checks Get It Wrong

-

By

Turn Staff

By

Turn Staff

- On

You probably heard this story before...

A company faced legal consequences for wrongfully denying employment to a job seeker, based on a misrepresentation in public records, and the inability for that job seeker to dispute the error in their results.

Errors in Background Checks

The Society for Human Resource Management conducted a study and discovered errors in 25% of background checks.

This statistic serves as a stark reminder that the best pre-employment screening providers support real-time dispute resolution.

Verónica Mastachi, Product Manager with over 4 years of experience at Turn, shares:

Finding false positives is a well-known scenario for background check companies. The challenge is to implement internal criteria and organic processes to ensure that the information reported is reasonably verified based on identifiers and time limit.

Allowing candidates to dispute upon receiving and reviewing their background check report is part of the nature of this industry. No impartial CRA denies or limits a candidate their right to dispute. Conducting a re-investigation is mandatory, and based on the results if the report is amended it has to be shared again with the employer and the candidate.

This essential step is what gives applicants a fair chance to be considered for the position they applied to. Once the amended report is shared with both parties, the final hiring decision is taken by the employer. Background check companies can make mistakes, human and system-related. Correcting constantly is part of our obligation to both the employers and the candidates.”

The Risk of Reporting False Information in Background Checks

Employers and consumer reporting agencies (CRAs) must take all necessary steps to ensure the accuracy of background checks and to comply with relevant regulations and agencies, such as the FCRA and the Consumer Financial Protection Bureau (CFPB).

As a starting point when discussing accuracy in background checks, it is crucial to consider risk associated with data entry errors. Candidates often make mistakes while inputting their personal identifiable information (PII), leading to inaccurate background checks that paint an unreliable image of potential employees. Mistakes also occur at the courthouses, when clerks are in charge of manually inputting the data related to criminal cases into the court electronic systems.

The accuracy of public record searches relies on verified identity. Compromised or misrepresented identities can result in inaccurate or incomplete public records, increasing the chances of false positives during background checks. If any of the PII found in public records doesn’t have a reasonable level of reliability to consider it a match/mismatch with the PII provided by the candidate, or if any mandatory fields are missing from the criminal charge, this can lead to reports that exclude certain hits, due to missing identifying information or lookback limits in local legislation.

To guarantee fast and accurate background checks, robust identity verification measures are a must. By establishing a solid foundation of identity verification, businesses can reduce the risk of relying on inaccurate public records. This approach enables a more precise assessment of a candidate’s background and minimizes the occurrence of false positives, ultimately resulting in faster and more accurate background checks.

To protect your business from inaccurate and incomplete background checks, it is recommended to establish policies and procedures with your background check provider to guarantee the fidelity of the information that is transferred among employers and CRAs in the process of requesting a background check.

Understand the FCRA and EEOC Guidelines

Understanding the regulations set forth by the Federal Trade Commission (FTC) and theEqual Employment Opportunity Commission (EEOC) is paramount to protecting your business from liability. These regulations, known as the Fair Credit Reporting Act (FCRA) and EEOC guidelines, ensure that background checks are conducted without any bias.

The FCRA establishes standards for consumer reporting agencies, which employers partner with to conduct the background check step of their hiring process. These agencies are responsible for taking reasonable steps to ensure accuracy and completeness of the reported information, allowing consumers to dispute any errors or outdated information, and restricting access to the report to only those with a legitimate need for it.

In addition, employers must comply with EEOC guidelines when using background checks in their hiring process. These guidelines prohibit employment discrimination based on race, ethnicity, religion, sex, nationality, age, or disability. It is crucial for employers to ensure that their background check process and hiring criteria do not unfairly impact specific groups of individuals.

Before conducting a background check, employers must obtain written consent from the candidate. Furthermore, if adverse action is taken based on the information found in the background check report, employers are required to provide a copy of the report to the individual affected.

To ensure compliance with Federal and State consumer reporting and labor laws, employers need to establish clear internal policies and procedures in all steps of their hiring process. These policies should include explicit instructions on how to handle Adverse Action against potential employees based on background check reports.

Work with Reputable Background Screening Companies

It is crucial for employers to partner with reputable background screening companies and ensure their compliance with FCRA regulations. These companies are responsible for satisfying FCRA standards of accuracy.

Employers should actively verify that their background screening company enhances the credibility and reliability of their services and maintain membership with the Professional Background Screening Association (PBSA).

Educate Your Staff

It is essential for employers to actively train their HR staff on FCRA and EEOC guidelines to maintain compliance throughout the hiring process. Also, your staff must understand the scope and limitations of the reports that your company receives. Employers should provide comprehensive training to all employees involved in hiring, covering the policies and procedures to adjudicate based on background checks results, handle adverse action, and ensure compliance with the FCRA and EEOC guidelines.

Final Thoughts

Background checks are a requirement in almost every hiring process, and each report can pose its own complexity. Also, the regulatory environment and state laws are constantly changing and imposing challenges to the screening industry at all levels. This can raise challenges for employers and CRAs together.

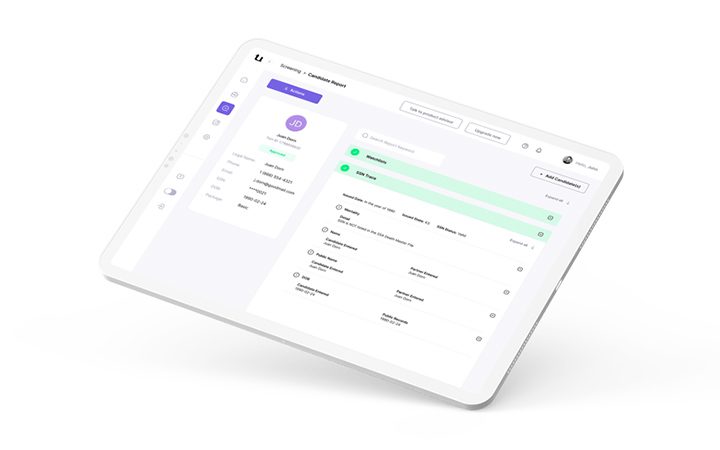

To address these challenges and protect and hire safely, it is important to choose a reputable background check company. At Turn, we achieve the industry’s highest accuracy due to innovative features such as our identity-verification-sequencing that ensures only verified identity information is passed to downstream courts and professional bodies thus reducing false positives. Additionally, we empower our partners to configure an optional pre-assent stage that allows for candidates to review and dispute charges, or confirm their report, before it is sent to the employer for adjudication.

When errors do inevitably occur, Turn provides an expedited dispute resolution process. Our in-house Compliance and Customer Experience teams are readily accessible to attend to any inquiries or issues in English or Spanish via Live Chat, Email, and Phone.

By choosing Turn, you may rest assured that your background check process follows reasonable procedures to ensure maximum possible accuracy and completeness.

Take the opportunity to schedule a free consultation with our experts to review your current screening process.

Recent Posts

- Enhancing Background Checks with County-Level Searches and Applicant Data

- Check Your Screening Provider’s Support, Speed, and Cost: Turn Does It Better

- You can have it all with Turn Technologies: Prioritizing Turnaround Time and Accuracy in Background Screening

- Understanding the Standards of Reportability of Publicly Available Information for CRAs and Employers

- Understanding the Limitations of Public Records in Medical Licensing Sanctions and Fraud Detection