Soft Credit Background Checks

-

By

Turn Staff

By

Turn Staff

- On

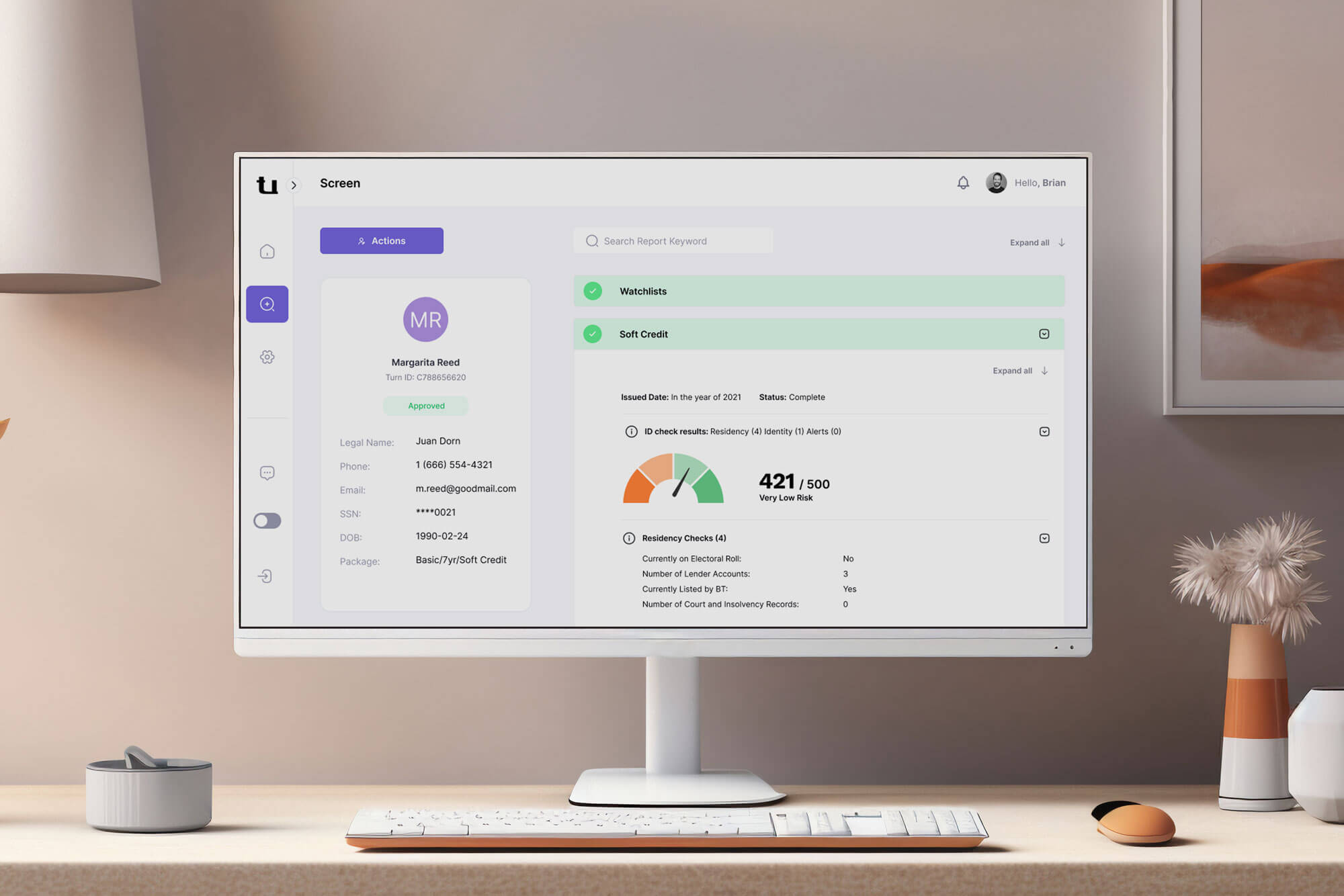

A credit history check provides insight into how candidates have managed credit in the past and can help inform hiring decisions for positions where employees have significant financial responsibilities.

The Importance of Credit Background Checks in Hiring

In the world of recruitment, ensuring you have the right person for the job is vital. Beyond evaluating skills and experience, delving into a candidate’s financial history through credit background checks can provide valuable insights, especially for roles where access to financial assets, transactions, and decisions is a primary responsibility.

Why do credit background checks matter?

- Identify Qualified Candidates: Gain a comprehensive and objective understanding of how candidates have managed their financial obligations in the past

- Make Informed Hiring Decisions: Reviewing a candidate’s financial decision-making skills prior to hiring allows employers to gauge their level of responsibility

- Reduce Organizational Risk: Credit checks for employment serve as a proactive measure to mitigate potential risks such as negligent hiring lawsuits, theft, or embezzlement

Insights Gained from Credit History Checks

- Understanding Financial History: Employment credit checks provide a detailed record of a candidate’s credit-to-debt ratio, offering a snapshot of their financial health without reporting their credit score

- Reviewing Past History: Credit background checks include information such as tax liens, accounts in collections, or bankruptcies

- Insights into Financial Responsibility: Account information can include outstanding balances, credit limits, and payment histories

By leveraging these checks, employers can make informed decisions, mitigate risks, and build a team of trustworthy individuals equipped to handle significant financial responsibilities.

Contact sales to learn more.

Disclaimer:

Turn’s Blog does not provide legal advice, guidance, or counsel. Companies should consult their own legal counsel to address their compliance responsibilities under the FCRA and applicable state and local laws. Turn explicitly disclaims any warranties or assumes responsibility for damages associated with or arising out of the provided information.

Recent Posts

- Enhancing Background Checks with County-Level Searches and Applicant Data

- Check Your Screening Provider’s Support, Speed, and Cost: Turn Does It Better

- You can have it all with Turn Technologies: Prioritizing Turnaround Time and Accuracy in Background Screening

- Understanding the Standards of Reportability of Publicly Available Information for CRAs and Employers

- Understanding the Limitations of Public Records in Medical Licensing Sanctions and Fraud Detection